What Is The Best Price Action Trading Strategy?

Plan your holidays and recharge yourself

What Is The Best Price Action Trading Strategy?

In today's world, there is an overwhelming amount of information available about price action trading. This can make it difficult to know where to start. Some people advocate for using a variety of price action setups, while others believe that it is better to focus on mastering one setup.

In my opinion, simplicity and discipline are the keys to success in price action trading. I recommend that traders start by mastering one setup, and only then progress to other setups. This requires a lot of patience and focused repetition, but it will ultimately build real skills.

The quest for the "best" price action system is futile. There is no single system that will work for everyone. Instead, it is better to focus on mastering a simple, high-probability setup and executing it with excellence. This will build the pattern recognition abilities and trading psychology necessary for lasting success.

In basketball, the legendary player Michael Jordan was known for his relentless practice and dedication to his craft. He would often spend hours in the gym, practicing the same drills over and over again. This repetition helped him to master the fundamentals of the game, which gave him a significant advantage over his opponents.

One of Jordan's most famous drills was the "wall drill." In this drill, Jordan would stand facing a wall and bounce the ball off the wall, catching it with both hands. He would then repeat this process over and over again, for hours on end. This drill helped Jordan to develop his hand-eye coordination and his ability to control the ball in mid-air.

Jordan's dedication to repetition and simplicity paid off in the long run. He went on to win six NBA championships and become one of the greatest basketball players of all time.

Similar to Jordan's basketball training, traders must begin with simplicity and repetition. Start by mastering one precise setup, like Jordan's wall drill, before expanding your arsenal. Focus intently on identifying that single pattern and executing it flawlessly, over and over. Build your skills from the ground up through deliberate practice.

Gradually add additional tools and techniques, but only once you've deeply ingrained the core price action setup. Construct your trading strategy piece by piece, founded on mastery of a high-probability foundation. This focused, incremental approach forms a cohesive framework to catch trades with precision, much like Jordan's fundamentals underpinned his success.

With enough repetition, the setup becomes second nature, allowing you to spot opportunities instinctively. What once took intense focus becomes automatic. Like Jordan dominating on the court, you'll gain an edge over competitors through mastering basics and expanding strategically. But it all starts with simplicity, repetition and single-minded focus.

As a practitioner of price action trading, a certain level of judgment is integral, as we do not adhere to a rigid rule-based system. This characteristic is advantageous as it accommodates the organic fluctuations and fluctuations inherent in markets. However, it also necessitates an ordered and methodical approach to learning and mastering each price action setup that you engage with. This meticulous process facilitates the development of a comprehensive comprehension, enabling you to discern when your price action strategy aligns and when it does not.

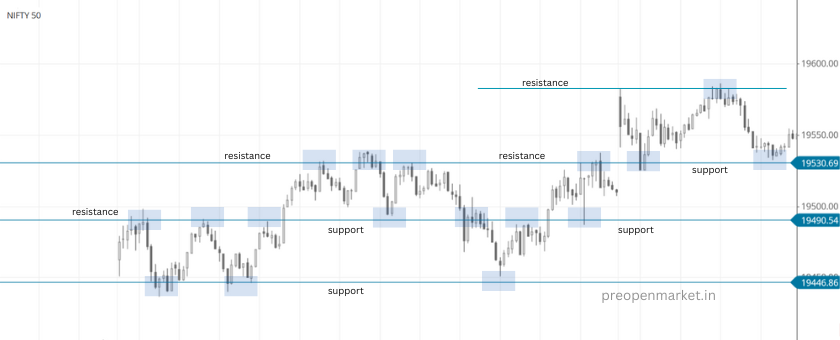

Consequently, embarking on this journey entails commencing with the fundamentals. The bedrock of price action trading lies in comprehending support and resistance levels.

The illustration below exemplifies the concept by outlining the most pertinent recent support and resistance levels within the context of the daily chart timeframe. Proficiency in delineating key chart support and resistance levels is imperative, as it directs your attention to the precise areas where potential price action signals can be identified for trading purposes:

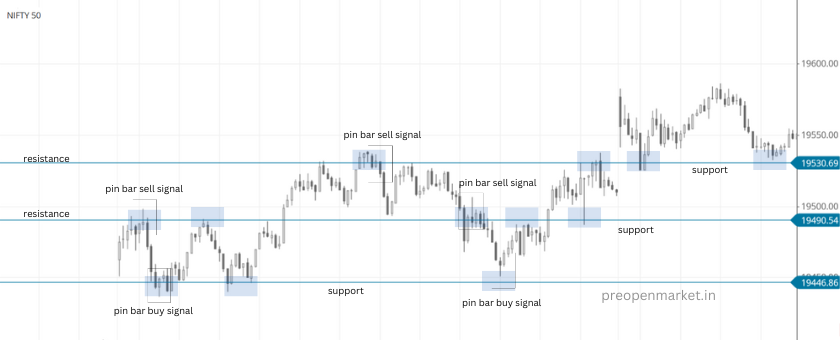

Once you've acquired the skill to recognize and accurately depict the essential support and resistance levels on your charts, you're ready to embark on the next step: searching for the initial price action signal you've opted to specialize in. In the current scenario, we're commencing with the pin bar strategy. Following the establishment of our designated levels, the subsequent task involves identifying conspicuous pin bar setups that have materialized precisely at or in close proximity to these delineated levels:

Subsequently, you might consider introducing an additional element that further validates your trade setups, enhancing the convergence of factors. In the subsequent illustration, our focus shifts towards recognizing the prevailing trend depicted on the daily chart, effectively integrating it into the equation. Consequently, all three components of your trading strategy seamlessly converge: the critical levels, the signal itself, and the prevailing trend. This synthesis culminates in the creation of a robust and high-probability entry system for price action trading:

The fundamental concept revolves around systematically learning and mastering individual components of your trading strategy before incorporating the next. In this instructional segment, our progression has encompassed several phases: initially grasping the technique of plotting essential chart levels, followed by the pursuit of pin bar trade signals situated precisely at or in close proximity to those designated levels. Subsequently, our approach involved executing trades based on these signals in harmony with the overarching daily chart trend. Achieving proficiency in each of these facets results in the cultivation of a remarkably robust trading strategy.

It's essential to note that this exemplifies merely one potential approach. You have the freedom to choose a different signal to begin with, tailoring the sequence to your preference. The central focus remains immersing yourself entirely in comprehending every facet of your chosen price action setup during each phase. To clarify, the content covered in this module can be regarded as a 'single setup.' Specifically, we've concentrated on identifying daily chart pin bars originating from significant chart levels, aligned with the prevailing daily chart trend. Once this mastery is achieved, a plethora of variations may follow suit: integrating 4-hour charts, 1-hour charts, incorporating 50% retracements, exploring diverse price action setups, and so forth. The key takeaway is to proceed at a measured pace, gradually mastering one price action setup before venturing into the next.