Introduction to Price Charts

graphical representations of the historical price

Introduction to Price Charts

Price charts are graphical representations of the historical price movements of financial assets over specific time periods. They are essential tools for traders, analysts, and investors to visualize and analyze market data, make informed decisions, and identify patterns, trends, and potential trading opportunities. Price charts provide valuable insights into the behavior of market participants and the supply and demand dynamics of a particular asset.

Key components of a price chart include:

-

Price Axis: The vertical axis on the chart represents the price levels of the asset being analyzed. The price range covered by the axis depends on the selected time frame.

-

Time Axis: The horizontal axis displays the time periods under consideration, such as minutes, hours, days, weeks, or months. Each time interval corresponds to a specific bar or candle on the chart.

-

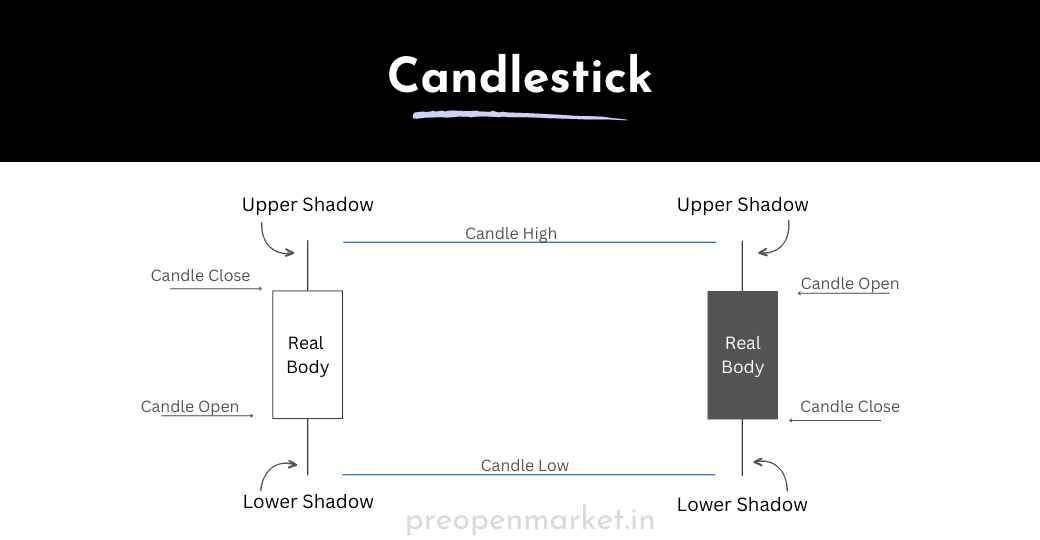

Candlesticks or Bars: Each period on the chart is represented by a candlestick or a bar. These visual elements show the open, high, low, and close prices of the asset within that period.

-

Open Price: The opening price of the asset during the chosen time interval is represented by the starting point of the candlestick or bar.

-

High Price: The highest price reached during the time interval is shown as the upper point of the vertical line (wick or shadow) on the candlestick or bar.

-

Low Price: The lowest price reached during the time interval is indicated by the lower point of the vertical line (wick or shadow) on the candlestick or bar.

-

Close Price: The closing price of the asset at the end of the time interval is represented by the ending point of the candlestick or bar.

Price charts come in various formats, with the most common types being:

-

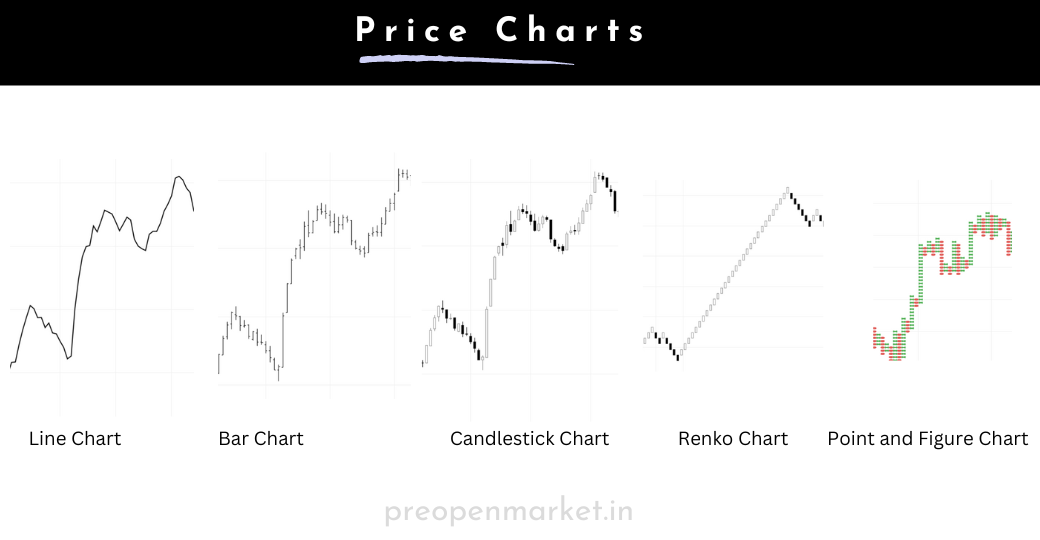

Line Chart: Connects the closing prices of an asset over time with a continuous line. It provides a simplified view of price trends.

-

Bar Chart: Uses vertical bars to show the range between the high and low prices for each period. The opening and closing prices are indicated by horizontal lines on the bar.

-

Candlestick Chart: Similar to a bar chart but visually more comprehensive. Each candlestick includes the same information as a bar (open, high, low, close) but is also color-coded to indicate whether the price rose (bullish) or fell (bearish).

-

Renko Chart: Represents price movements in bricks of a predetermined size, ignoring time. New bricks form only when the price moves beyond a specified threshold.

-

Point and Figure Chart: Focuses solely on price movements and ignores time. It uses Xs and Os to represent bullish and bearish price movements, respectively.

Price charts serve as a foundation for technical analysis, allowing traders to apply various tools and techniques to identify patterns, trends, support and resistance levels, and potential entry and exit points for trading decisions. By studying price charts, market participants can better understand the market's behavior and make informed judgments about future price movements.

Price charts can be used to identify support and resistance levels, trend lines, and patterns. They can also be used to calculate technical indicators, such as moving averages and relative strength index (RSI).

To use price charts effectively, it is important to understand the different types of charts and how to interpret them. It is also important to practice using price charts on a demo account before trading with real money.

Here are some additional tips for using price charts:

- Use multiple time frames: It is best to use multiple time frames to get a better understanding of the market trend. For example, you could use a daily chart to identify the overall trend, and then use a 4-hour chart to identify potential trading opportunities.

- Use technical indicators: Technical indicators can help you to confirm price action signals and to identify potential trading opportunities. However, it is important to remember that technical indicators are lagging indicators, which means that they can only tell you what has happened in the past, not what will happen in the future.

- Use a stop loss: Always use a stop loss to limit your losses in case the trade goes against you.

- Be patient: Don't enter a trade just because a price action signal is triggered. Wait for a good opportunity to enter a trade.

- Practice on a demo account: Before you start trading with real money, it is important to practice using price charts on a demo account. This will allow you to learn how to use the price action techniques and to develop your trading skills.