Fakey Trading Strategy [Inside Bar False Break Out]

A price action pattern-based approach

Fakey Trading Strategy [Inside Bar False Break Out]

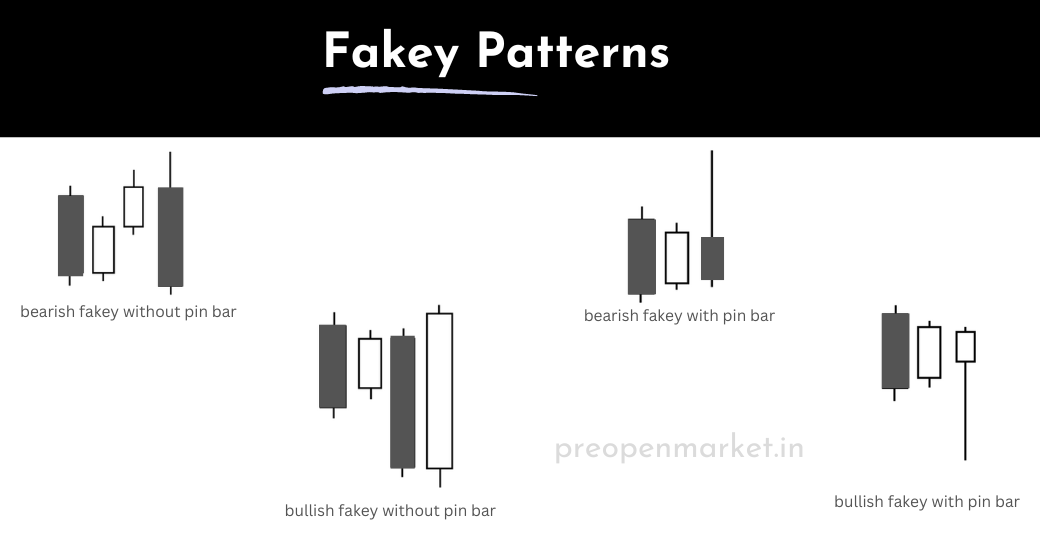

The Fakey Trading Strategy, also known as the Inside Bar False Break Out strategy, is a price action pattern-based approach used by traders to identify potential reversal and continuation trading opportunities. This strategy relies on a combination of inside bars and false breakouts to capture market movements.

Here's how the Fakey Trading Strategy works:

1. Inside Bar Formation: An inside bar is a candlestick pattern where the entire price range (high to low) of one candle is inside the range of the preceding candle. This indicates a period of consolidation or indecision in the market.

2. False Breakout: The strategy revolves around the concept of a "false breakout." This occurs when the price initially breaks out of the range of the inside bar but then reverses and closes back within the range of the inside bar. The false breakout traps traders who entered the market on the breakout, leading to a reversal.

3. Entry and Stop Loss: After the false breakout, traders enter a trade in the opposite direction of the initial breakout, anticipating a reversal. For a bullish Fakey, traders enter a long position above the high of the inside bar, placing a stop-loss order below the low of the inside bar. For a bearish Fakey, traders enter a short position below the low of the inside bar, with a stop-loss above the high of the inside bar.

4. Target and Risk Management: Traders often use a risk-to-reward ratio to set their profit targets. For example, if the stop-loss is 50 pips away, the profit target might be set at a distance that offers a 2:1 or 3:1 reward-to-risk ratio. Traders can also consider trailing their stop-loss as the trade moves in their favor.

5. Confirmation and Additional Factors: While the Fakey pattern itself can provide a valuable signal, traders may enhance their analysis by considering additional factors. These could include trend direction, support, and resistance levels, and the overall market context.

It's important to note that not all inside bars with false breakouts will lead to successful trades. Like any trading strategy, Fakey requires practice, experience, and risk management. Traders should use proper position sizing and consider their overall trading plan when implementing the strategy.

As with any trading approach, it's recommended to test the Fakey strategy on historical data and practice in a demo trading environment before applying it to real-money trading. Additionally, traders should stay updated on market conditions and continuously refine their strategy based on their observations and results.

Here are some additional tips for trading the fakey pattern:

- Use multiple time frames: It is best to use multiple time frames to confirm the fakey pattern. For example, you could use a 4-hour chart to identify the inside bar pattern and a 1-hour chart to confirm the breakout and reversal.

- Use a stop loss: Always use a stop loss to limit your losses in case the trade goes against you.

- Be patient: Don't enter a trade just because you see a fakey pattern. Wait for the price to close back inside the inside bar range before entering a trade.

- Practice on a demo account: Before you start trading with real money, it is important to practice on a demo account. This will allow you to learn how to trade the fakey pattern and to develop your trading skills.