Pin Bar and Inside Bar Combo Trading Strategy

A popular price action-based approach

Pin Bar and Inside Bar Combo Trading Strategy

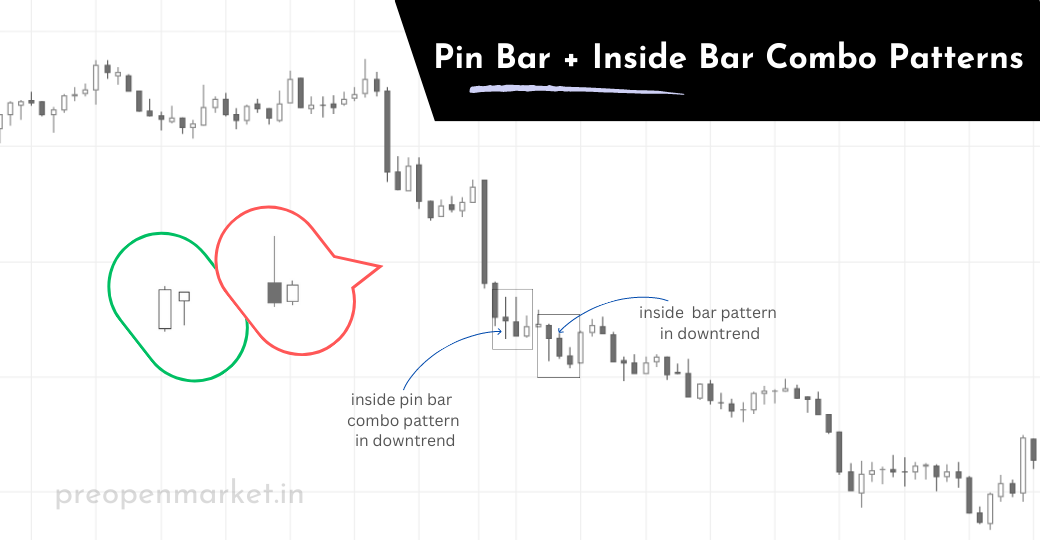

The Pin Bar and Inside Bar Combo Trading Strategy is a price action-based approach that combines the principles of two popular candlestick patterns: the Pin Bar and the Inside Bar. This strategy aims to identify potential reversal or continuation trading opportunities by observing the interactions between these two candlestick patterns.

Here's how the Pin Bar and Inside Bar Combo Trading Strategy works:

1. Pin Bar Formation: A Pin Bar, or "Pinocchio Bar," is a candlestick pattern characterized by a long tail (wick) that extends beyond both the open and close prices, forming a small body. A bullish Pin Bar has a long tail below the body, and a bearish Pin Bar has a long tail above the body.

2. Inside Bar Formation: An Inside Bar forms when the entire price range (high to low) of a candle is contained within the high and low of the previous candle. It represents a period of consolidation and indecision.

3. Pin Bar and Inside Bar Combo: In this strategy, traders look for the interaction between a Pin Bar and an Inside Bar. Specifically, the Pin Bar should be followed by an Inside Bar.

4. Entry and Stop Loss: Traders wait for the high or low of the Inside Bar to be broken, signaling a potential continuation or reversal of the Pin Bar's direction. For example, if the Pin Bar is bullish and is followed by a bullish Inside Bar, traders may enter a long position above the high of the Inside Bar. The stop-loss can be placed below the low of the Inside Bar.

5. Target and Risk Management: Traders typically set profit targets based on support and resistance levels, trendlines, or other technical factors. Risk management techniques, such as trailing stop-loss orders or adjusting position sizes, can help manage potential losses.

6. Confirmation and Context: While the Pin Bar and Inside Bar Combo provides a potential trade setup, traders often enhance their analysis by considering additional factors such as the overall trend, key support and resistance levels, and other technical indicators.

7. Trade Continuation or Reversal: Depending on the direction of the Pin Bar and the Inside Bar, traders can use this strategy to anticipate either a continuation of the prevailing trend or a potential reversal.

8. Demo Testing and Practice: Before applying the strategy in live trading, traders should practice on historical data and in a demo trading environment to gain experience and refine their execution.

The pin bar and inside bar combo trading strategy is a relatively reliable trading pattern, but it is important to use it in conjunction with other technical analysis tools. You should also use a stop loss to limit your losses in case the trade goes against you.

As with any trading strategy, it's important to exercise caution and manage risk. While the Pin Bar and Inside Bar Combo can provide valuable trade signals, not every setup will result in a successful trade. Traders should use proper risk management techniques and ensure the strategy aligns with their overall trading plan and risk tolerance.