Pin Bar Trading Strategy

A price action strategy

Pin Bar Trading Strategy

The Pin Bar Trading Strategy is a popular price action-based approach used by traders to identify potential reversal or continuation trading opportunities in the financial markets. The strategy centers around a specific candlestick pattern known as the "Pin Bar," which stands for "Pinocchio Bar" due to its resemblance to Pinocchio's long nose.

Here's how the Pin Bar Trading Strategy works:

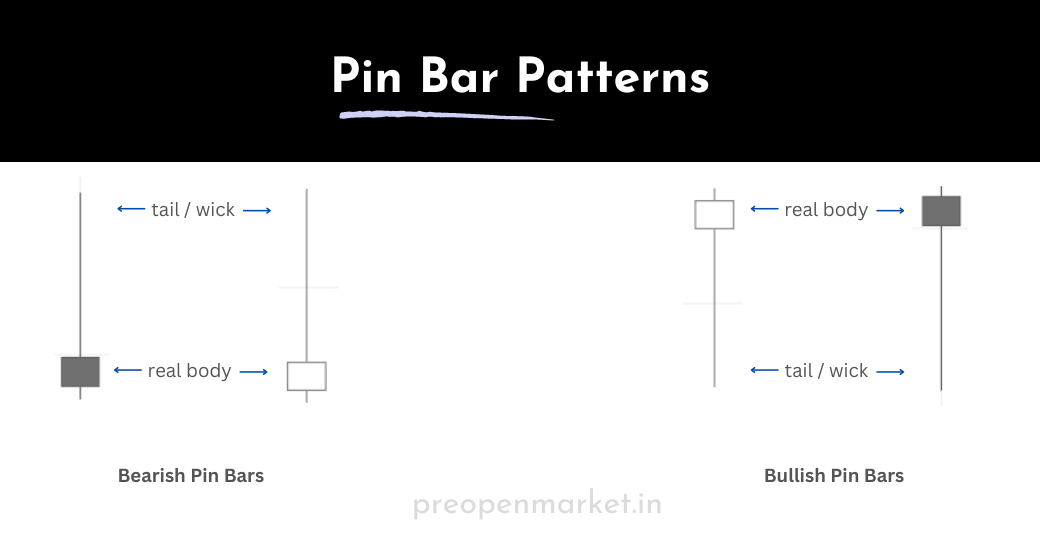

1. Pin Bar Formation: A Pin Bar is a candlestick pattern with distinct characteristics:

- The body of the candle is small, representing a narrow price range between the open and closed prices.

- The wick (or "shadow") of the candle extends far beyond both the open and close prices.

- The wick can be positioned either above or below the body, creating a "tail" that resembles Pinocchio's nose.

2. Bullish and Bearish Pin Bars: A bullish Pin Bar has a long tail below the body, indicating a potential reversal from a downtrend to an uptrend. A bearish Pin Bar has a long tail above the body, suggesting a potential reversal from an uptrend to a downtrend.

3. Reversal and Continuation Signals: Bullish Pin Bars at the bottom of a downtrend and bearish Pin Bars at the top of an uptrend can signal potential trend reversals. However, Pin Bars can also act as continuation signals if they occur within a prevailing trend.

4. Entry and Stop Loss: Traders often enter a trade in the direction indicated by the Pin Bar's tail. For example, a bullish Pin Bar may prompt traders to enter a long position. The stop-loss order is typically placed below the low of a bullish Pin Bar or above the high of a bearish Pin Bar to protect against potential losses.

5. Target and Risk Management: Traders set profit targets based on technical levels such as support and resistance, trendlines, or other price action patterns. Risk management techniques, such as using a favorable risk-to-reward ratio, help manage potential losses.

6. Confirmation and Additional Factors: While Pin Bars can provide valuable trade signals, traders often enhance their analysis by considering additional factors such as the overall trend, key support and resistance levels, and other technical indicators.

7. Practice and Experience: As with any trading strategy, practice and experience are essential. Traders should test the strategy on historical data and practice in a demo trading environment before applying it to real-money trading.

It's important to note that not every Pin Bar will lead to a successful trade, and traders should exercise caution and proper risk management. The Pin Bar Trading Strategy is just one tool in a trader's toolkit, and it's advisable to consider a comprehensive approach that integrates multiple forms of analysis and risk management techniques.

Here are the key points:

- A pin bar is a single candlestick with a long tail or wick, and a small real body at one end. The body represents the open and close prices, while the tail shows the high/low range.

- In a pin bar, the tail is much longer than the body, indicating rejection of the previous price move. The small body shows indecision or consolidation.

- The nose or direction of the pin bar body indicates the potential new direction of the market after the rejection. An up nose signals potential upside, a down nose signals potential downside.

- To trade, place a pending buy/sell stop order just beyond the tail of the pin bar in the direction the nose is pointing. Use a stop loss above/below the high/low of the tail.

- Target a minimum 1:2 or 1:3 risk/reward ratio. Move the stop to breakeven once the target is reached.

- Look for pin bars at key support/resistance levels or Fibonacci retracements for the highest probability setups.

- The pin bar shows rejection of price and potential reversal, allowing traders to capitalize on the change in market direction very early.

So in summary, the pin bar strategy uses the pin bar candlestick pattern to time entries and exits based on market rejections and reversals.